|

|

Week of 2-26-2024

|

|

|

Inside this issue

- PSEA President advocates for solutions to school staff shortage

- Two elementary school teachers use their musical talents to give back

- School funding fast facts: Tax equity payments

- 2024 Fabric of Unionism Art Competition now accepting entries

- Upcoming Center for Professional Learning events and PEARL

- Member Benefits spotlight: URL life insurance

|

|

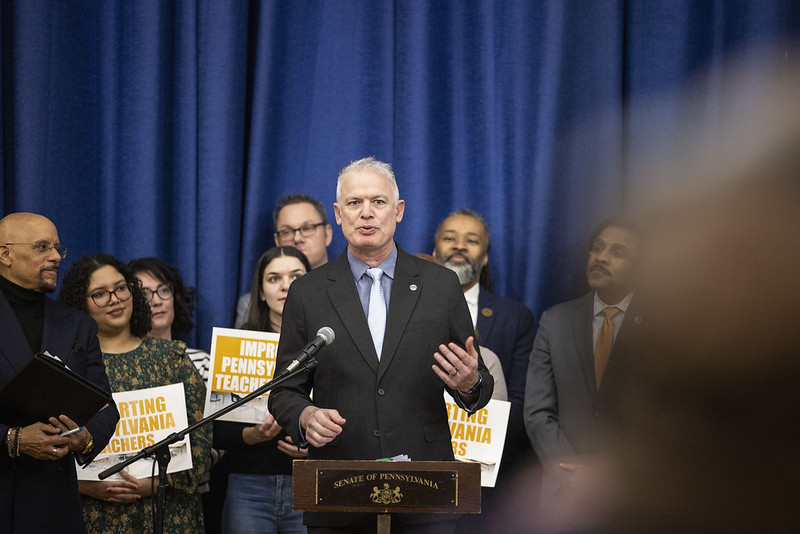

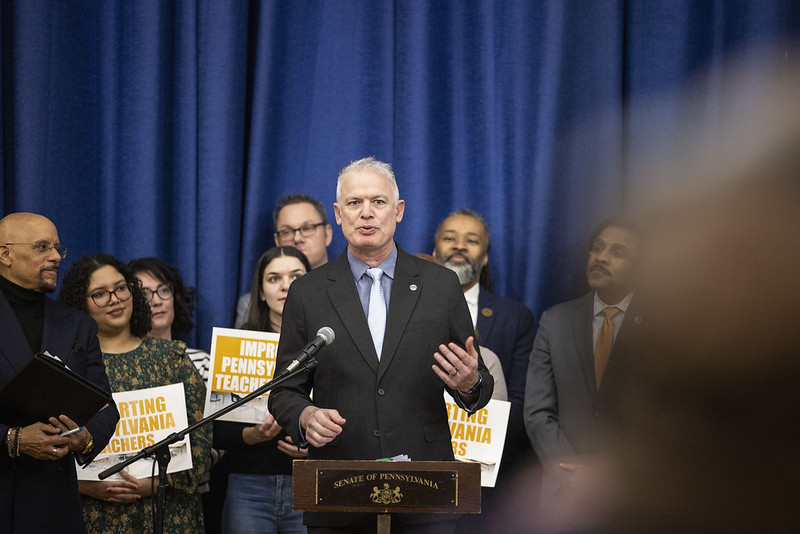

PSEA President advocates for solutions to school staff shortage

On Monday, PSEA President Aaron Chapin joined a host of state leaders, lawmakers, and education advocates to discuss solutions to Pennsylvania’s teacher shortage at a Philadelphia press conference arranged by state Sen. Vincent Hughes.

With the number of new teacher certificates issued in Pennsylvania declining by more than 70 percent in the last decade, the school staff shortage has become a critical issue. And solving it is a top priority for PSEA. In his remarks, Chapin thanked Gov. Shapiro for proposing a significant increase in funding to help address the issue but pointed out it’s just a first step.

“When school began this fall, there were widespread teacher vacancies in districts in every part of the state,” Chapin said. “That means hundreds of thousands of Pennsylvania students arrived in a brand new year and teachers were missing from the classroom.”

The solution is to increase programs like the student teacher stipend that PSEA and Sen. Hughes championed and to raise pay across the board to make a career in education competitive and attractive both to incoming and existing education professionals.

|

|

Two elementary school teachers use their musical talents to give back

The Substitutes is an acoustic music duo formed by two full-time elementary school teachers, guitarist Mark Alexander and drummer Fred Lawrence, who met while playing in a Christian rock band. The name is a self-deprecating play on them both being teachers who “substitute for the real musicians out there.” But judging by their steady gig calendar and ability to play requests off a list of 600 songs fans can access via a QR code at their shows, it seems their success speaks for itself.

The duo, based in neighboring school districts of Mifflinburg (Alexander) and Midd-West (Lawrence), performs live music for everything from weddings to middle school dances, blending various genres ranging from country to rock. Their musical journey began over a decade ago, evolving from their shared passions for music and teaching.

Initially, their performances were purely for enjoyment, but they soon integrated a fundraising aspect into their gigs in response to several tragedies that befell children and families in their school communities. They’ve managed to raise more than $5,000 for various causes via a tip jar over the last few years, with no intention of slowing down.

“As school teachers, we’re known in the public, and we feel it’s our social-moral obligation if we have the platform to reach out,” Alexander said. “It just made sense to put our needs aside for a while and help others.”

Watch for a complete interview with The Substitutes in the upcoming May issue of Voice magazine.

|

|

School funding fast facts: Tax equity payments

Another important component of Gov. Josh Shapiro’s proposed $1.1 billion public school funding increase is a tax equity supplement that would provide additional state funds to school districts that have high local tax effort when compared with the rest of Pennsylvania’s school districts. Under Gov. Shapiro’s proposal, a school district with high local tax effort has local tax effort in the top 34 percent of all school districts. The governor’s proposal, which is based on the Basic Education Funding Commission’s Jan. 11 report, would phase this funding in over seven years.

How are tax equity payments calculated in the governor’s plan?

- A school district qualifies for the tax effort supplement if, when putting the local tax effort of all 500 school districts in rank order, the school district’s tax effort is higher than 66 percent of all school districts. (Local tax effort is higher than 1.55 percent.)

- A school district’s local tax effort is a percentage, calculated by dividing a school district’s total local tax revenues by the sum of the market value of all property and the total personal income earned by people living in the school district.

- The first step in the calculation of the tax equity payment an eligible school district would receive is to determine the difference between the total dollar amount of the local taxes it currently collects and the dollar amount of local taxes the school district would collect if its local tax revenues equaled 1.55 percent of the total market value and personal income in the school district.

- In the second step of the calculation, approximately two-thirds of school districts that would qualify for tax equity payments would have their payments reduced because they have higher property values and personal incomes than the typical school district. No tax equity payment would be reduced to zero by this adjustment process.

- For example, if the hypothetical Anytown School District currently collects local taxes equal to 1.8 percent of its total market value and personal income, it would qualify for the tax equity supplement because its local tax effort is higher than 1.55 percent.

- If Anytown School District currently collects $48,960,000 in local taxes (1.8 percent of its total market value and personal income) and if it would collect $42,160,000 in local taxes if its tax effort was 1.55 percent (1.55 percent of its total market value and personal income), then its payment would equal $6,800,000 ($48,960,000 - $42,160,000).

- This payment would be phased in over seven years, with the school district receiving $971,429 a year in new funding on top of any new formula-driven funds it might be eligible for each year as the state increases its basic education subsidy.

Hypothetical Tax Equity Payment Calculation: Anytown School District

- Anytown SD Total Market Value and Personal Income: $2,720,000,000

- Anytown SD Total Local Tax Revenues: $48,960,000

- Anytown SD Local Tax Effort: 48,960,000/$2,720,000,000 = 1.8 percent (total local tax revenues/total market value and personal income)

- Local Tax Revenues If Anytown SD’s Local Tax Effort Was 1.55 Percent: $42,160,000

- Anytown SD Tax Equity Supplement: $6,800,000 over seven years (total local tax revenues - local tax revenues if tax effort was 1.55 percent)

- Anytown SD Annual Tax Equity Payment: $971,429 each year for seven years

How many school districts qualify for tax equity funding?

In total under the governor’s proposal, 169 school districts would qualify for a tax equity payment.

|

|

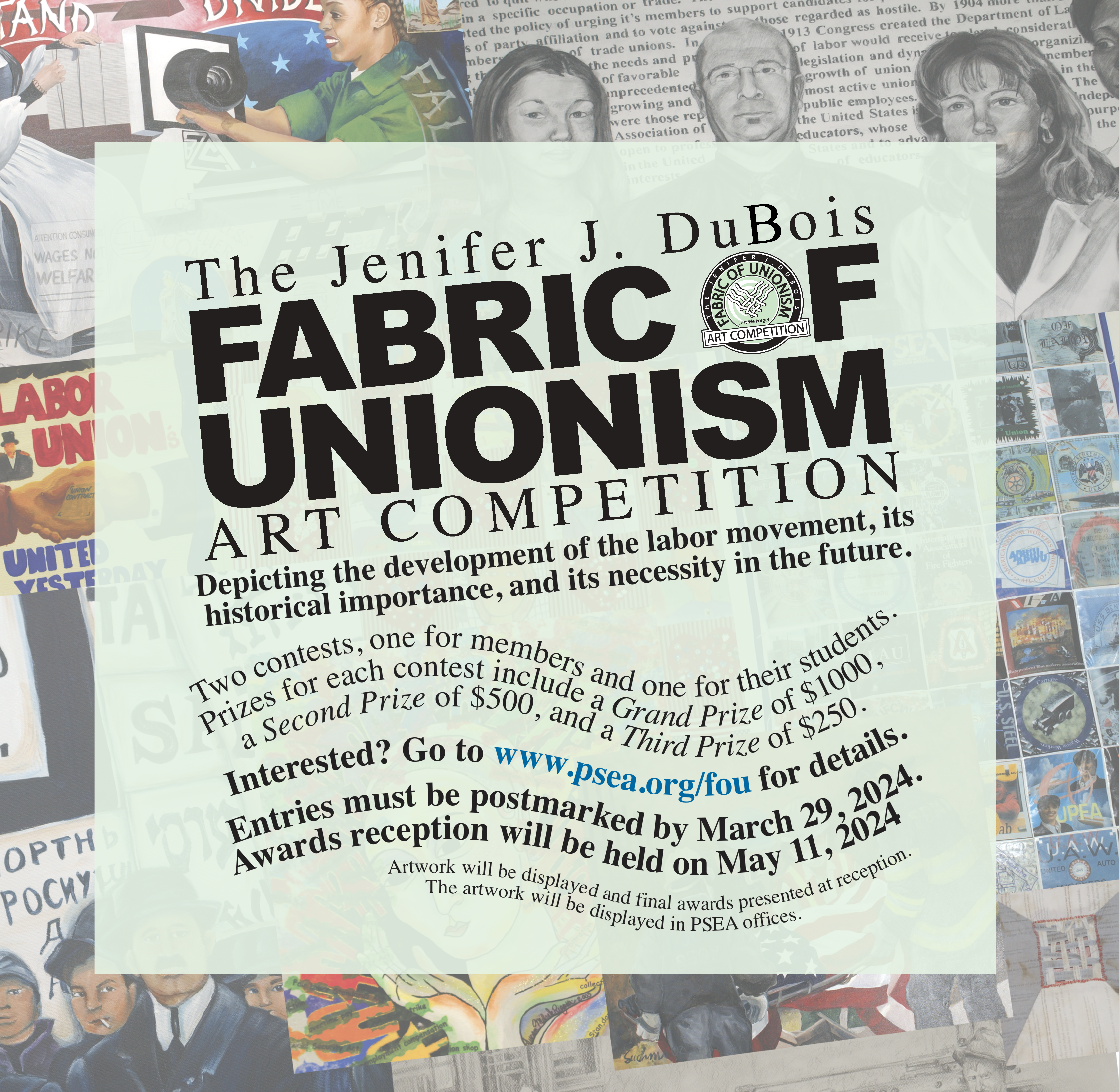

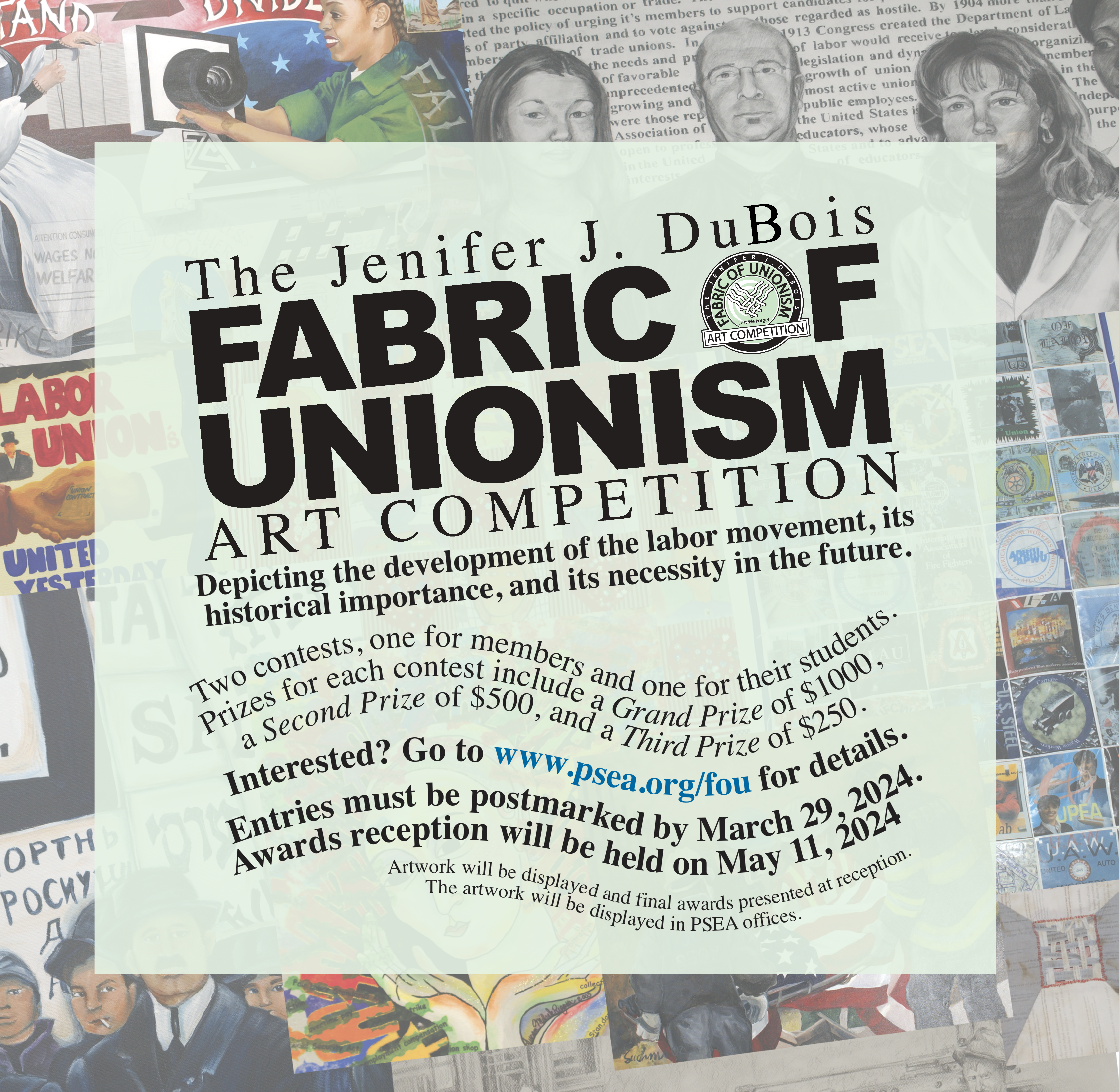

2024 Fabric of Unionism Art Competition now accepting entries

You and your students have the chance to share your artwork and win some sweet prize money in the process!

Every two years, PSEA holds the Jenifer J. DuBois Fabric of Unionism Art Competition. The purpose of the competition is to increase awareness of the labor movement, its historical importance, and the need for it to grow in the future.

What you need to know:

- Two contests, one for members and one for their students

- Prizes for each contest include a Grand Prize of $1000, a Second Prize of $500, and a Third Prize of $250

- Entries must be postmarked by March 29, 2024

- Awards reception will be held on May 11, 2024

Click the link below to find out more and see past winners.

|

|

Upcoming Center for Professional Learning events and PEARL

Visit the new, improved PEARL today and choose from more than 95 asynchronous courses available for Act 48 credit and Chapter 14 verification.

You can find multiple courses that interest you in any of these tracks:

- Book Studies

- Educational Equity

- Pedagogy

- Policy

- Pupil Services

- Special Populations

- Technology in Education

- SEL & Wellness

- Fostering a "Growth Mindset" in the Classroom Today: Shifting the Focus to Growth and Development with Assessment & Grades Rather than Measurement for Sorting & Classification (ECE Series)

- Be Prepared: Efficient and Informed IEP Meetings (ECE Series)

- Online Polling for Student Engagement & Assessment

- Science Cross-Cutting Concepts Picture Book Study

- Flip Your Classroom: Reach Every Student in Every Class Every Day (Revised Edition)

- Good Different (Poetry)

Earn postgraduate credits from PennWest University for $70 each!

More than 150 postgraduate credits are available across a wide range of teaching and learning topics.

These postgraduate credits (microcredentials) can count toward the 24 credits required for a Level II certificate and also may count toward salary advancement.*

For support professionals, these courses may meet Chapter 14 requirements.**

*Check your contract to determine if you can apply standalone postgraduate credits for column movement.

**Seek approval from your employer prior to completing hours to apply toward Chapter 14 requirements.

|

|

Member Benefits spotlight: URL life insurance

URL Insurance Group is the life insurance provider for PSEA members and their families. URL understands that it shouldn’t take a lifetime to apply for life insurance coverage. That’s why they offer the ability to get instant-decision life insurance.

PSEA members and family members (ages 18-60) can now get a term life insurance quote in seconds and be insured in minutes, all from a smartphone. Coverage starts at $50,000 and goes up to $1.5 million. No doctors, no hassles, no waiting. If you’re over the age of 60 or have kids and/or grandchildren under the age of 18, URL has you covered as well.

Click the link below to access the instant quote and instant-decision life insurance:

Or, click the link below if you prefer to have a consultation regarding life insurance options:

|

|

|

400 N. 3rd Street, Harrisburg, PA 17101

|

|

This content is intended for PSEA members and their immediate families.

|